Link copied

22:11 | 29 January 2021

The popular service Robinhood banned users to open long positions on shares of video game retailer GameStop, telecommunications company Nokia and the world’s largest cinema chain AMC, Bloomberg reported. Users of the service can only sell shares of these companies.

Robinhood has also restricted transactions in the securities of telecommunications company BlackBerry, home improvement chain Bed Bath & Beyond, retailers Express and Naked Brand Group and headphone, headset and microphone manufacturer KOSS Corporation. Robinhood users will no longer be able to buy these papers.

Robinhood’s decision made social media users very angry. Even after the blocking of the Discord server WallStreetBets, where they discussed the flash mob, as well as reports about the White House interest in their activities, they said: hedge funds are doing everything to get even by any means. And they saw the ban on GameStop stock purchases as just another “sneaky trick” from Wall Street.

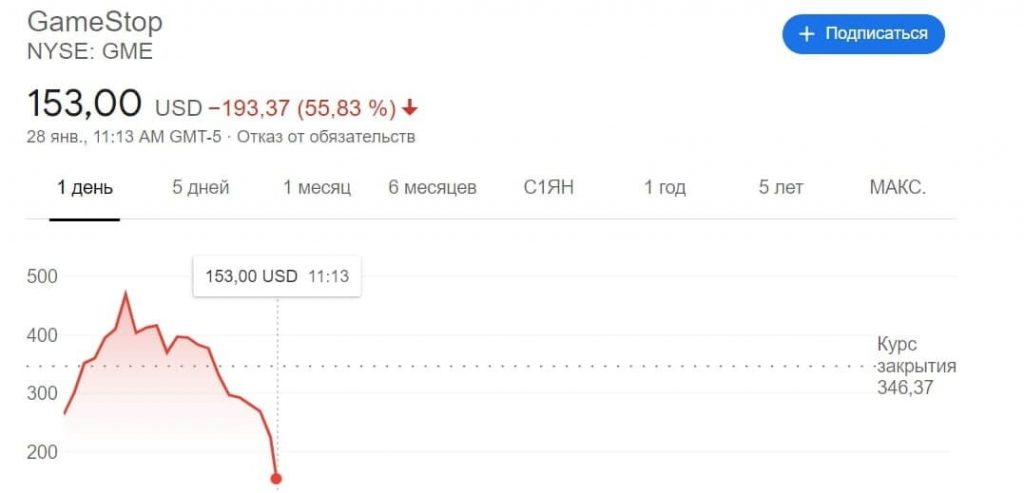

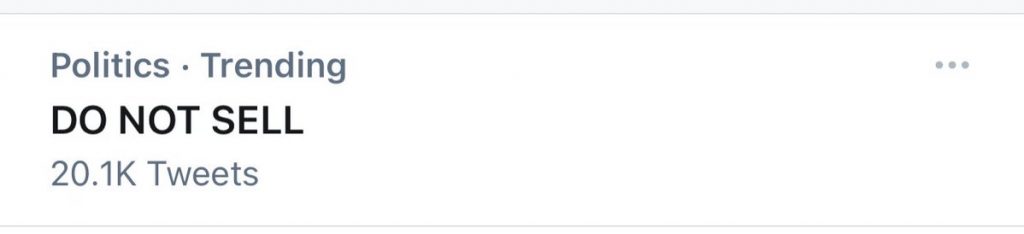

The WallStreetBets community expressed a theory: Robinhood intentionally left only the function of selling stocks, so that cautious investors would get rid of them. And since there will be no buyers, the share price will go down. That’s why the message “DON’T SELL” was entrenched in the U.S. Twitter top.

So members of the Wall Street Bets community on Reddit wanted to stop short-sellers who were betting on falling stocks. They were outraged that hedge funds were “sinking” GameStop. The investment firms themselves have already lost billions of dollars as a result of the campaign.

Follow the information in a convenient format: Telegram, Facebook, YouTube.

Back

Back

Head office

10:00 am - 7:00 pm

MON-FRI

V zářezu 902/8, Jinonice, 158 00 Praha 5

+420 255 790 513

+420 255 790 513

Technical support

+420 255 790 513

+420 255 790 513

Now we are considering the application, the manager will contact you soon.