Link copied

18:20 | 19 May 2021

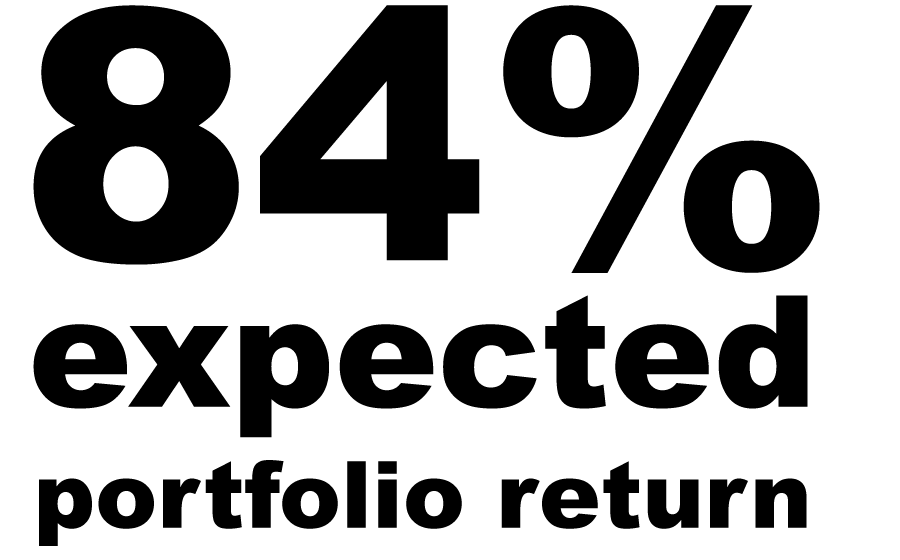

The OTC Shares strategy is a portfolio that includes the top 3 companies that are already planning to go public this year, which means that you don’t have to wait several years before a company announces that it will go public.

You can already see a yield in excess of three digits within a year.

Each of the companies included in this portfolio already has a weighty background and successful development history, and analogues and competitors of these companies are already traded on the stock exchange and show good growth and stable dynamics.

Each of the companies in this portfolio already has a weighty experience and successful development history, and analogues and competitors of these companies are already traded on the stock exchange and show good growth and stable dynamics.

OTC markets are what solves the problem of small companies’ securities turnover – the OTC market is where you can buy promising shares at a price hundreds of percent lower than the value after the IPO.

When it comes to what is the OTC market, you cannot equate the OTC market with the stock exchange.

Working at OTC Markets is more difficult because of the need to predict the behavior of young companies.

There is no usual exchange liquidity, so it’s not always possible to sell securities quickly.

Over The Counter Market is more often used for medium- and long-term investing.

This is a chance to buy promising securities and keep them until the company goes through IPO.

This strategy is ideal for those people who look at the long term, understand that investment is patience, and patience is rewarded.

The OTC market is actively gaining momentum and gives an opportunity to earn times more than just buying at IPO. In the history there are a lot of examples of the companies which showed the growth between the rounds only by 50 and even more than 100%.

That’s why we assembled this portfolio and provided the opportunity to invest at once in three giant companies

Robinhood is the developer of a mobile stock trading app designed to democratize access to financial markets. The free stock trading app for global companies provides real-time market data and allows investors to forgo the full range of trading platform services in exchange for the ability to buy a wide selection of stocks and ETF’s without paying commissions or fees, allowing them to invest in assets they can afford and without paying fees. In October 2019, Robinhood announced its Cash Management product and associated debit card, giving users an additional level of financial flexibility through the app.

Website: www.robinhood.com

Sector: Financial Services

Headquarters: New York, NY

Staff Number: 1,886

Year Established: 2013

Robinhood is the developer of a mobile stock trading app designed to democratize access to financial markets. The free stock trading app for global companies provides real-time market data and allows investors to forgo the full range of trading platform services in exchange for the ability to buy a wide selection of stocks and ETF’s without paying commissions or fees, allowing them to invest in assets they can afford and without paying fees. In October 2019, Robinhood announced its Cash Management product and associated debit card, giving users an additional level of financial flexibility through the app.

Website: www.impossiblefoods.com

Sector: Food

Headquarters: Redwood City, California

Number of Employees: 375

Year Established: 2011

Netskope is developing a smart cloud security service platform designed to help companies take advantage of the cloud without compromising security. The Netskope Cloud Security platform helps companies eliminate blind spots with big data analytics, protect data across multiple locations and devices, and stop elusive real-time attacks with a single platform.

Website: www.netskope.com

Sector: Cyber Security

Headquarters: Santa Clara, California

Staff Number: 990

Year Established: 2012

The OTC market expands opportunities for traders and investors.

Thanks to OTC Markets there is an opportunity to invest in shares of small companies with business scaling potential.

Pre-IPO investments give an opportunity to earn many times more as compared to investments in the same shares after listing on the stock exchange.

Follow the information in a format that is convenient for you: Telegram, Facebook, YouTube

Back

Back

Head office

10:00 am - 7:00 pm

MON-FRI

V zářezu 902/8, Jinonice, 158 00 Praha 5

+420 255 790 513

+420 255 790 513

Technical support

+420 255 790 513

+420 255 790 513

Now we are considering the application, the manager will contact you soon.